Market Selection Strategy: Identifying the Best Countries for Selling Overseas

Expanding into international markets offers businesses unparalleled opportunities for growth—but only if the right market is chosen. Market selection is the critical first step in selling overseas, shaping everything from revenue potential to brand positioning and long-term sustainability. Entering the wrong market can mean costly regulatory hurdles, mismatched consumer demand, or unsustainable operating costs, while the right choice can unlock new revenue streams and accelerate global expansion.

At Metheus Consultancy, we emphasize a structured, research-driven approach to market selection as part of a wider market entry strategy. In our comprehensive guide to market entry, operations, and risk management, we explore the full spectrum of challenges businesses face when expanding abroad. In this article, we’ll go deeper into the specifics of market selection—highlighting the factors to consider, how to conduct in-market research, how to draw conclusions from your findings, and how to turn insights into an actionable market entry strategy.

With the right framework, tools, and decision-making process, businesses can move beyond guesswork and confidently identify the best overseas opportunities for sustainable growth.

The Importance of Market Selection in Global Expansion

When it comes to international expansion, market selection is not just a first step—it is the foundation that determines long-term success or failure. Many companies rush into overseas markets because they see competitors entering, or because a particular country appears “trendy” for investment. However, without a structured approach to choosing the right market, businesses risk facing regulatory barriers, cultural mismatches, and lower-than-expected demand.

The importance of market selection in global expansion lies in its ability to:

Minimise risk: Careful evaluation helps businesses avoid costly mistakes such as entering markets with high trade restrictions, unstable economies, or low consumer demand.

Maximise resources: Expansion requires significant financial and operational commitment. Selecting the right market ensures that budgets, staff, and logistics are invested where they can deliver the highest returns.

Accelerate growth: By aligning products and services with the needs of the most receptive customers, companies can achieve faster adoption and stronger brand recognition.

Strengthen competitiveness: Early movers in the right market gain an advantage in market share and brand positioning, while late or poorly planned entries often struggle to catch up.

A successful global growth story often starts with rigorous market research and evaluation frameworks. For example, tech companies expanding into Asia often prioritise markets like South Korea or Singapore due to high digital adoption, while retailers may look at Central and Eastern Europe for rapidly growing consumer bases. Each industry requires a different lens, but the underlying principle remains the same: selecting the right market creates the conditions for sustainable expansion abroad.

By prioritising data-driven market selection rather than relying on assumptions or intuition, businesses can build stronger global strategies and position themselves for long-term profitability.

Key Factors to Consider When Selecting a Market

Choosing the right overseas market is a multi-layered process that requires analysing a combination of economic, cultural, and operational variables. A structured international market selection framework helps businesses reduce risks and identify the most profitable opportunities. Below are the six critical factors to evaluate before selling overseas.

1. Market Size and Growth Potential

The first step in market selection for global expansion is evaluating the market’s overall size and long-term growth prospects. Look at GDP growth rates, consumer spending or customer purchasing patterns, and demand indicators specific to your industry. For example, fast-growing economies often offer untapped customer bases and expanding middle classes with rising purchasing power. A large market with stagnating growth may not be as attractive as a smaller but rapidly expanding one. Always assess both the current demand and the future scalability of your products or services.

2. Industry Trends and Competition

Understanding industry trends and competitive dynamics in your target market is essential. Is the market saturated with established players, or is there room for innovation? Evaluating local competitors, market maturity, and innovation levels gives insight into your potential positioning. Entering a market too early may require heavy investments in education and awareness, while entering too late could mean fighting for limited market share. Identifying gaps and emerging trends helps businesses craft a strong international sales strategy that aligns with customer expectations.

3. Regulatory Environment

Every country has its own set of laws, licenses, and compliance requirements that directly affect foreign businesses. A favourable regulatory environment can fast-track your entry, while strict regulations may increase costs and limit flexibility. Consider factors like import/export restrictions, data privacy laws, foreign ownership rules, and product-specific certifications. Understanding the regulatory landscape in advance helps companies avoid fines, delays, and reputational risks, ensuring a smoother path to market entry success.

4. Cultural and Consumer Behaviour

No global expansion strategy can succeed without understanding local culture and consumer behaviour. Language barriers, buying habits, customer values, and even lifestyle preferences influence how products are perceived. For example, packaging design, product size, or payment preferences may need adaptation to fit local demand. Companies that fail to adapt to cultural nuances often struggle to connect with consumers, while those that localise effectively achieve stronger brand loyalty and faster adoption rates.

5. Logistics and Infrastructure

Even if demand is strong, logistics and infrastructure can make or break your success. Assess whether the market has reliable supply chains, transportation networks, warehousing, and digital infrastructure. Ports, highways, and air freight capacity are crucial for product-based businesses, while robust internet penetration and e-commerce platforms are vital for digital-first companies. Weak infrastructure leads to higher operational costs and delivery delays, directly impacting customer satisfaction and profitability.

6. Costs and Pricing Dynamics

Finally, consider the total cost of market entry and how it affects your pricing strategy. Tariffs, import duties, and local taxes can significantly raise the cost of doing business. At the same time, price sensitivity among consumers varies by region—premium pricing may succeed in high-income markets but fail in cost-sensitive economies. Businesses should also factor in overheads such as staffing, marketing, and distribution costs. Developing a competitive yet profitable pricing strategy is essential to achieving sustainable overseas growth.

By carefully analysing these six key market selection factors, businesses can make smarter, data-driven decisions and identify the markets most likely to deliver long-term success in their international expansion journey.

Using Data and Research to Drive Market Selection

In today’s competitive business landscape, companies that succeed in selling overseas are those that use data-driven market research to validate assumptions. A structured approach to global market research ensures that decisions are based on evidence rather than guesswork.

Secondary Data Sources

The first step in evaluating overseas opportunities is leveraging secondary data—readily available market insights compiled by global organisations and research firms. Valuable sources include:

World Bank and IMF reports for economic growth projections

OECD and WTO databases for trade flows and policy updates

Statista, Euromonitor, and Nielsen for consumer spending patterns and industry benchmarks

Government trade bodies and chambers of commerce for country-specific regulations and market statistics

Using these sources provides a macro-level view of each market, helping businesses compare GDP growth, industry performance, and consumer behaviour across regions.

Primary Research Methods

While secondary data paints the big picture, primary research provides the local insights needed to refine strategy. This includes:

Customer surveys and interviews to understand buying behaviour, preferences, and brand perception

Focus groups and product testing to validate cultural fit and product-market alignment

Mystery shopping and retail audits to analyse competitor offerings, pricing, and distribution channels

Pilot sales or soft launches to measure real-world demand before full-scale investment

Primary research ensures that businesses don’t just rely on theory but understand the on-the-ground realities of their target market.

Competitive Benchmarking

A crucial element of international market research is comparing your company against both local and global competitors. Analysing competitor market share, product features, pricing strategies, and distribution models highlights potential gaps your brand can fill. This competitive intelligence allows companies to position themselves more effectively and anticipate potential threats.

Turning Data into Action

Collecting data is only useful if it leads to clear, actionable insights. Businesses should synthesise findings into structured reports that answer key questions:

Is there sufficient demand for our product or service?

What entry barriers exist, and how costly are they to overcome?

How does our value proposition compare with local competitors?

Which distribution channels and partnerships are most effective?

How Metheus Consultancy Supports Data-Driven Market Selection

At Metheus Consultancy, we specialize in turning research into actionable strategy. Our services include:

In-market guides that provide clients with practical, country-specific playbooks for successful entry.

Tailored data research that combines global databases with industry-specific insights to pinpoint high-potential opportunities.

Hands-on primary research, including surveys, customer interviews, and pilot testing, to validate real-world demand.

Competitive benchmarking that identifies market gaps and helps clients position their products or services against local and international players.

By combining secondary research for macro-level trends with primary research for micro-level insights, businesses can create a data-driven market entry strategy that reduces uncertainty and improves chances of success.

How to Conduct Market Research In-Market

In-market research is what truly validates your assumptions and reveals the nuances of local consumer behaviour, competitive dynamics, and regulatory realities. Conducting research directly in the target country is an essential step in building a successful international expansion strategy and ensuring your products or services are positioned for success.

Engage Local Partners and Trade Organisations

A cost-effective way to gather reliable insights is by working with local business partners, trade associations, and chambers of commerce. Partnering with a trusted local distributor, consultant, or market research agency can help you navigate cultural barriers and regulatory complexities while speeding up your market entry process.

Metheus Consultancy frequently supports clients in this stage by providing industry reports, consumer studies, and competitor benchmarks that are not publicly available. We also help facilitating introductions to reliable in-market partners and trade bodies, ensuring faster access to trustworthy local intelligence.

Conduct On-the-Ground Market Visits

Visiting the target market allows businesses to experience conditions firsthand. Store checks, product comparisons, and retail visits help identify consumer preferences, price ranges, and merchandising strategies. Speaking directly with potential customers and observing how they interact with competitors’ products can reveal hidden opportunities that no desk research can provide. For B2B industries, attending local trade fairs and industry conferences offers direct access to decision-makers and helps validate demand.

Leverage Digital and Social Media Research

In addition to face-to-face interactions, digital market research has become an indispensable tool. By monitoring social media conversations, online reviews, and e-commerce platforms, companies can uncover real-time consumer sentiment, trending products, and purchase motivations. Keyword research and search engine analytics also indicate how often customers are searching for products or services similar to yours, providing a clear measure of local demand.

Metheus integrates digital listening tools and e-commerce data analysis into client research projects, offering insights that go beyond traditional surveys and highlight consumer demand signals in real time.

Balance Quantitative and Qualitative Insights

Successful in-market research combines hard data with human perspectives. While surveys and statistical analysis provide measurable insights into demand size, income levels, and purchasing power, qualitative methods such as interviews, focus groups, and cultural immersion help uncover why consumers buy the way they do. Balancing these two approaches ensures your findings are both statistically valid and culturally grounded.

Metheus Consultancy’s research frameworks blend quantitative data models with qualitative insights, ensuring clients gain a holistic understanding of their target markets.

Pilot Testing and Soft Launches

Before committing to full-scale entry, many businesses conduct pilot programs or soft launches in their chosen market. This may include introducing a limited product line, testing localised marketing campaigns, or working with a small group of retailers. Such initiatives provide real-world validation of product-market fit and allow companies to refine their strategy before scaling.

Metheus supports clients in designing and executing pilot launches, from product positioning to localised marketing tests, providing data-driven feedback that de-risks full-scale international expansion.

By combining local partnerships, structured visits, digital monitoring, and pilot testing, businesses can ensure their in-market research delivers actionable insights. With Metheus Consultancy’s tailored services, companies gain not only data but also the strategic guidance to translate those findings into successful market entry strategies.

How to Draw Conclusions from Your Research

Conducting international market research is only the beginning—the real value comes from drawing the right conclusions and turning data into strategy. Many businesses collect information but struggle to transform it into actionable insights. A structured approach helps companies synthesise findings, identify risks, and prioritise the markets most aligned with their global expansion strategy.

Synthesising Data into Clear Findings

After gathering both secondary data (economic indicators, trade flows, consumer spending reports) and primary research (surveys, interviews, in-market visits), the next step is to consolidate the information into clear, digestible insights. Instead of drowning in spreadsheets and raw numbers, businesses need to identify what the data is actually saying about market demand, competition, and entry barriers.

At Metheus Consultancy, we specialise in building structured insight reports that cut through the noise and highlight the opportunities that truly matter for decision-makers.

Identifying Patterns, Risks, and Hidden Opportunities

Data alone rarely tells a full story—it’s about spotting patterns. For example, you might see strong GDP growth but low consumer confidence, or high e-commerce adoption but weak logistics infrastructure. These contradictions often reveal both risks and hidden opportunities. Companies that can recognise these nuances gain an edge by entering markets that others may overlook.

Metheus consultants combine quantitative analysis with sector expertise to surface these insights, ensuring that risks are flagged early while growth opportunities are maximised.

Ranking Markets Based on Key Criteria

The most effective way to move from data to action is by applying a ranking framework. Markets can be scored against clear criteria such as growth potential, accessibility, regulatory ease, and cultural alignment with your ICP (Ideal Customer Profile). This allows businesses to compare opportunities side by side and make confident go/no-go decisions.

Metheus Consultancy leverages proprietary decision intelligence models to build these ranking systems, helping clients objectively prioritise markets instead of relying on subjective judgment or internal biases.

Avoiding Bias and Over-reliance on a Single Data Source

One of the biggest pitfalls in market selection research is leaning too heavily on a single source or metric. Relying only on GDP figures, for example, may cause businesses to ignore cultural fit or competitive intensity. Similarly, anecdotal evidence from one market visit may distort the overall picture. Balanced evaluation from multiple sources is the key to accurate conclusions.

At Metheus, we mitigate bias by triangulating data across multiple research streams—economic databases, consumer insights, competitive benchmarking, and in-market testing—ensuring that clients receive a comprehensive, balanced perspective.

How to Turn Research Findings into Actionable Strategy

Collecting and analysing data is only valuable if it leads to actionable strategy. Many companies stop at research reports, but the real competitive advantage comes from translating insights into clear market entry decisions. By aligning research findings with business objectives and building structured frameworks, businesses can turn knowledge into growth.

Aligning Findings with Business Goals

Not every attractive market is the right fit for your company. The key is to align market insights with your strategic goals—whether that’s revenue growth, increasing market share, or building global brand visibility. For example:

A company focused on short-term revenue may prioritise fast-growing, high-demand markets.

A brand positioning itself as premium may choose fewer, more sophisticated markets where consumers value quality over price.

Businesses seeking scale may select markets with strong partnership ecosystems.

At Metheus Consultancy, we help clients bridge the gap between research and strategy by mapping findings directly against their long-term objectives and resource capabilities.

Building a Go/No-Go Decision Framework

One of the most effective ways to act on research is by creating a go/no-go framework. This involves defining non-negotiable criteria (such as regulatory accessibility, cost of entry, or ICP alignment) and evaluating each shortlisted market against them. By using a scoring system, leadership teams can make objective, data-backed decisions rather than relying on intuition or internal bias.

Metheus’ proprietary decision intelligence models are designed exactly for this—giving clients a structured, repeatable process for market selection and expansion planning.

Creating Phased Entry Strategies

Market entry is rarely a one-step process. Successful companies often adopt phased strategies to minimise risk and maximise learning. Options include:

Pilot programs to test demand before scaling

Partnerships or joint ventures to leverage local expertise and infrastructure

Acquisitions to accelerate market entry and secure immediate presence

By sequencing entry in phases, companies can adapt quickly to real-world challenges while keeping investments under control.

Metheus supports clients in designing these phased strategies, from pilot tests to full-scale rollouts, ensuring that each stage is informed by data and aligned with growth targets.

Frameworks for Evaluating Markets

When entering new international markets, relying solely on intuition is risky. Businesses need structured frameworks to evaluate opportunities objectively and consistently. The right frameworks make it easier to compare multiple countries, identify risks, and prioritise the markets most aligned with your growth strategy.

1. PESTEL Analysis

A PESTEL analysis is one of the most widely used frameworks for evaluating foreign markets. It examines six external factors that can make or break international expansion:

Political – Government stability, trade agreements, tariffs, foreign investment policies

Economic – GDP growth, inflation, consumer spending power, exchange rate volatility

Social – Demographics, cultural attitudes, lifestyle trends, consumer values

Technological – Digital adoption, e-commerce maturity, innovation ecosystems

Environmental – Sustainability regulations, environmental risks, carbon policies

Legal – Compliance requirements, licensing, intellectual property protection

By systematically reviewing these elements, businesses gain a 360-degree view of market risks and opportunities. For example, a country may have strong consumer demand but also strict data protection laws that affect digital businesses. PESTEL ensures that no critical factor is overlooked.

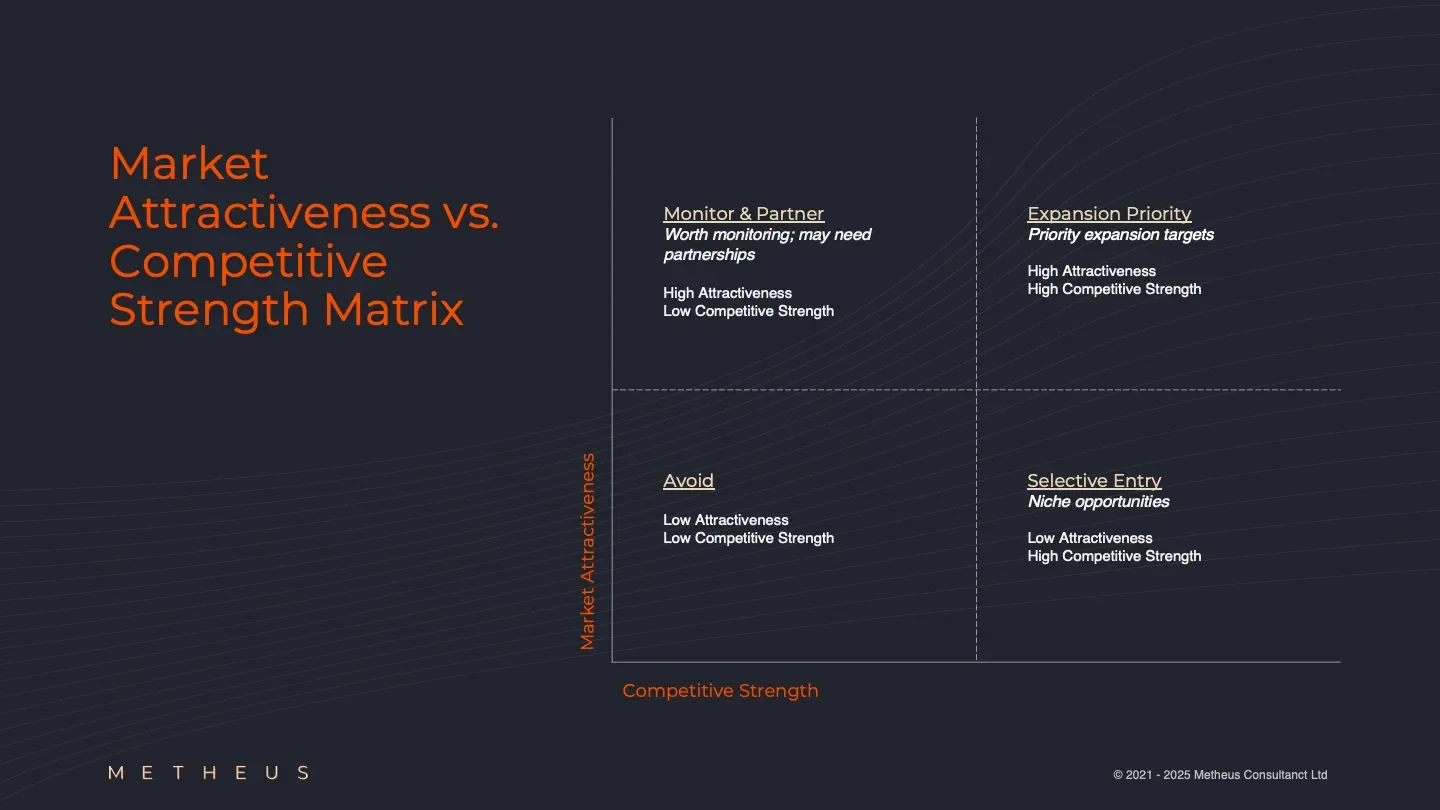

2. Market Attractiveness vs. Competitive Strength Matrix

Another powerful tool is the Market Attractiveness vs. Competitive Strength Matrix, which helps companies score and compare countries on two dimensions:

Market Attractiveness – size, growth potential, profitability, ease of entry

Competitive Strength – how well your company’s resources, brand, and value proposition fit the market compared to competitors

Markets are then plotted into four categories:

High Attractiveness + High Competitive Strength → Priority expansion targets

High Attractiveness + Low Competitive Strength → Worth monitoring; may need partnerships

Low Attractiveness + High Competitive Strength → Niche opportunities; selective entry

Low Attractiveness + Low Competitive Strength → Avoid

This framework allows leadership teams to visualize trade-offs and make informed decisions about where to invest.

At Metheus Consultancy, we use enhanced scoring models that integrate financial, operational, and cultural factors, making the analysis more tailored and actionable for each client.

3. ICP (Ideal Customer Profile) Alignment

Even if a market looks attractive on paper, success depends on whether your Ideal Customer Profile (ICP) exists in significant numbers and aligns with local demographics and behaviours. ICP alignment ensures that your products and services resonate with the right buyers.

Key considerations include:

Demographic match – Does the local population fit your ICP in terms of age, income, education, or lifestyle?

Behavioural alignment – Do consumers in the market shop the way your ICP typically does (e.g., online vs. in-store)?

Value perception – Does the market appreciate the premium, sustainability, or innovation factors that define your brand?

For example, a luxury skincare brand may find higher success in markets with growing middle and upper classes that value premium self-care, while a cost-driven brand may thrive in markets with high price sensitivity.

For B2B companies expanding internationally, aligning your Ideal Customer Profile (ICP) with the realities of the target market is critical. Even if a country looks attractive on paper, expansion will only succeed if there is a sufficient concentration of businesses that match your ICP. ICP alignment ensures that your solutions resonate with the right decision-makers, industries, and buyer segments.

Key considerations for B2B ICP alignment include:

Firmographics – Do the local businesses match your target company size, industry vertical, and geographic distribution? For example, SaaS providers may focus on mid-to-large enterprises in finance, logistics, or healthcare.

Decision-Maker Profiles – Who are the key stakeholders in the buying process? Understanding roles (e.g., CIOs, procurement heads, R&D directors) ensures your messaging and sales approach are relevant.

Buying Behaviour – How do companies in the target market typically purchase solutions? Some may prefer long RFP processes, while others rely on local distributors or partnerships.

Technology Adoption & Maturity – Is the market digitally mature enough for your solution, or will adoption require significant education and change management?

Value Perception – Does your ICP in the market prioritise cost savings, innovation, risk reduction, or compliance? Positioning your value proposition accordingly is essential for traction.

For example, a predictive analytics platform may find a stronger ICP fit in markets with digitally advanced hospital networks or financial institutions than in markets with fragmented or underfunded sectors.

Metheus Consultancy helps clients adapt their ICP frameworks to each target country, ensuring customer segmentation and positioning strategies are localised and data-driven.

By combining PESTEL analysis, attractiveness-strength matrices, and ICP alignment, businesses can build a robust, multi-layered approach to international market evaluation. These frameworks reduce risk, sharpen decision-making, and ensure that global expansion strategies are based on evidence, not assumptions.

Practical Steps in Market Selection

Step 1: Define Business Goals

Clarify what success looks like for your expansion. Is your priority revenue growth, market share, brand visibility, or long-term positioning? A company focused on quick wins will approach market selection differently from one seeking strategic partnerships or global dominance.

Step 2: Shortlist Potential Markets

Start by screening global markets using high-level indicators such as GDP growth, industry demand, consumer demographics, and digital readiness. This process narrows the list to countries worth deeper analysis.

Step 3: Apply Scoring Models or Decision Intelligence Frameworks

Use structured tools like PESTEL analysis, market attractiveness vs. competitive strength matrices, and ICP alignment to evaluate markets objectively. Decision intelligence frameworks help companies avoid bias and compare opportunities side by side.

Step 4: Conduct Feasibility Studies

Once top markets are identified, dive deeper with feasibility studies that assess legal barriers, logistics, cultural fit, and entry costs. This phase validates assumptions and highlights risks before significant investments are made.

Step 5: Pilot Entry or Phased Launch Strategy

Instead of entering with a full rollout, start with pilot programs, partnerships, or limited product launches. This phased approach reduces risk, allows for real-world learning, and provides flexibility to adapt before scaling.

Metheus Consultancy guides clients through each of these steps, using proprietary research models, competitive benchmarking, and market entry planning to ensure decisions are data-driven and strategically sound.

Common Pitfalls to Avoid

Even well-prepared businesses can stumble during market selection for selling overseas. Avoiding these common mistakes can save significant time, money, and reputation.

Following “popular” markets without data validation – Just because competitors are entering a country doesn’t mean it’s the right fit for your brand.

Ignoring hidden costs – Customs duties, product localisation, legal compliance, and HR expenses often inflate budgets beyond initial estimates.

Underestimating cultural differences – Consumer preferences, payment methods, and marketing channels may differ drastically, and failure to adapt can lead to poor adoption.

Over-expanding too quickly – Entering multiple markets at once stretches resources thin and increases operational risks. A focused, phased approach is usually more sustainable.

At Metheus, we help clients avoid these pitfalls by combining data validation, risk analysis, and cultural adaptation strategies into every market entry plan.

Example Case Study: RebusLabs Market Selection with Metheus Consultancy

RebusLabs AG is a Switzerland-based company that provides automated cold chain monitoring solutions for healthcare, pharmaceuticals, food & beverage, FMCG, and logistics industries. Their modular platform combines smart devices, sensors, and a secure cloud system to ensure real-time monitoring of temperature-sensitive products, helping clients maintain product safety, regulatory compliance, and brand protection. RebusLabs’ solutions—such as Modus, Locus, and Focus—are trusted by Swiss hospitals, global FMCG brands, and logistics companies

The Challenge

RebusLabs approached Metheus Consultancy with the goal of expanding into new international markets. While the leadership team saw opportunities across Europe, the Middle East, and Asia, they lacked clarity on which market offered the best balance of demand, accessibility, and scalability.

Our Approach

We applied our structured market selection framework, combining:

PESTEL analysis to assess political stability, economic growth, and regulatory readiness.

Competitive benchmarking against regional and global SaaS providers.

ICP alignment to match RebusLabs’ Ideal Customer Profile with local demographics and buying behaviour.

Primary in-market research, including interviews with potential enterprise clients and channel partners.

Key Findings

Germany and the Benelux region emerged as the strongest opportunities due to advanced healthcare systems and need for digital adoption.

Germany was prioritized thanks to its large healthcare market, world-class university hospitals, and openness to research-based collaborations.

Outcome

Metheus designed and executed a Detailed Channel Utilisation Strategy, helping RebusLabs enter Germany with precision. As a result:

RebusLabs successfully onboarded one of Germany’s largest university hospitals, Mainz, as a flagship client.

Together with Mainz, RebusLabs developed joint case studies, performance benchmarks, and optimization reports.

These deliverables were then leveraged as proof of success when approaching other hospitals across Germany and the Benelux region.

Lessons Learned

Market size alone is not enough—regulatory readiness and cultural fit are equally critical.

ICP alignment ensures product-market fit and accelerates adoption.

A phased, partnership-led entry strategy reduces risk and maximises early traction.

This case highlights how Metheus Consultancy helps clients like RebusLabs move from uncertainty to clarity—turning research into actionable, profitable international expansion strategies.

👉 You can read the full case study here:

How RebusLabs Achieved Success with Metheus Consultancy

Conclusion

Choosing the right overseas market is not a matter of guesswork—it is the cornerstone of every successful international expansion strategy. From assessing market size, competition, and regulations to conducting in-market research and applying structured frameworks, businesses that take a data-driven approach significantly increase their chances of long-term success. The journey doesn’t end with research; the ability to translate insights into actionable strategies, phased entry plans, and sustainable growth models is what separates thriving global brands from costly missteps.

At Metheus Consultancy, we help companies move beyond assumptions by delivering tailored market research, competitive benchmarking, and hands-on expansion strategies that ensure each market decision is backed by evidence and aligned with business goals. Whether you are planning your first overseas entry or scaling into multiple regions, our Market Entry Operations services provide the clarity, structure, and execution support needed to succeed.

👉 Learn more about how we can guide your global expansion journey here: Market Expansion Planning & Market Entry Operations